Be in command of the way you grow your retirement portfolio by using your specialized information and interests to invest in assets that suit with all your values. Received abilities in property or personal equity? Use it to guidance your retirement planning.

IRAs held at banks and brokerage firms supply minimal investment alternatives to their customers simply because they don't have the know-how or infrastructure to administer alternative assets.

An SDIRA custodian differs since they have the appropriate staff, expertise, and potential to keep up custody from the alternative investments. The first step in opening a self-directed IRA is to find a provider that is specialised in administering accounts for alternative investments.

Number of Investment Alternatives: Ensure the company will allow the kinds of alternative investments you’re thinking about, including real-estate, precious metals, or private fairness.

From time to time, the costs related to SDIRAs can be higher plus more complicated than with an everyday IRA. This is due to with the elevated complexity affiliated with administering the account.

Complexity and Obligation: With an SDIRA, you've got additional control more than your investments, but You furthermore mght bear extra obligation.

A self-directed IRA is undoubtedly an very potent investment car, however it’s not for everybody. Given that the stating goes: with fantastic ability arrives great accountability; and with the SDIRA, that couldn’t be more real. Keep reading to discover why an SDIRA may well, or won't, be to suit your needs.

Several buyers are surprised to know that utilizing retirement cash to invest in alternative assets has long been achievable considering the fact that 1974. Nonetheless, most brokerage firms and banking institutions give attention to presenting publicly traded securities, like shares and bonds, because they lack the infrastructure and experience to manage privately held assets, including real estate property or non-public fairness.

The main SDIRA guidelines through the IRS that traders need to have to be familiar with are investment limits, disqualified folks, and prohibited transactions. Account holders will have to abide by SDIRA procedures and polices so that you can maintain the tax-advantaged status of their account.

Limited Liquidity: Lots of the alternative assets that can be held in an SDIRA, for instance real estate, personal equity, or precious metals, is probably not effortlessly liquidated. This can be a concern if you might want to access money promptly.

Opening an SDIRA can present you with usage of investments Commonly unavailable by way of a financial institution or brokerage company. Right here’s how to begin:

Introducing hard cash on to your account. Understand that contributions are matter to annual IRA contribution restrictions established through the IRS.

Assume your Buddy could be starting up the subsequent Facebook or Uber? Using an SDIRA, you could invest in triggers that you think in; and likely take pleasure in greater returns.

This read the article features knowing other IRS regulations, taking care of investments, and avoiding prohibited transactions which could disqualify your IRA. A lack of information could lead to highly-priced blunders.

And because some SDIRAs such as self-directed regular IRAs are subject to expected minimum distributions (RMDs), you’ll really need to system forward to ensure that you've got ample liquidity to satisfy the rules established because of the IRS.

Simplicity of use and Know-how: A consumer-pleasant System with on the net equipment to track your investments, submit documents, and handle your account is critical.

Larger investment solutions indicates it is possible to diversify your portfolio beyond shares, bonds, and mutual resources and hedge your portfolio from industry fluctuations and volatility.

Going cash from 1 style of account to a different type of account, for example transferring resources from a 401(k) to a conventional IRA.

As soon as you’ve found an SDIRA provider and opened your account, you could be wondering how to truly start out investing. Knowing both of those the rules that govern SDIRAs, and also the best way to fund your account, may help to put the inspiration for a future of thriving investing.

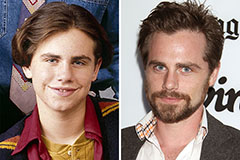

Rider Strong Then & Now!

Rider Strong Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!